Growing $400,000 to $1,000,000 and why I believe we will get there sooner rather than later

Skill. Timing. Fundamental Analysis. Research, Research and Research. Thinking independently of others. And most importantly avoiding mistakes - the big ones. It sounds simple, right?

Why do I think I can turn $400k into $1 Million Dollars [and quickly]?

Well first of all we’re already up to $522,000 in 35 days. So the results speak for themselves (!) , however…

You can follow along with the basic portfolios (Growth, Growth+, Medium Risk etc.) [see link below] and see the trades being made in real-time over the last month:

https://www.youtube.com/@400kProject

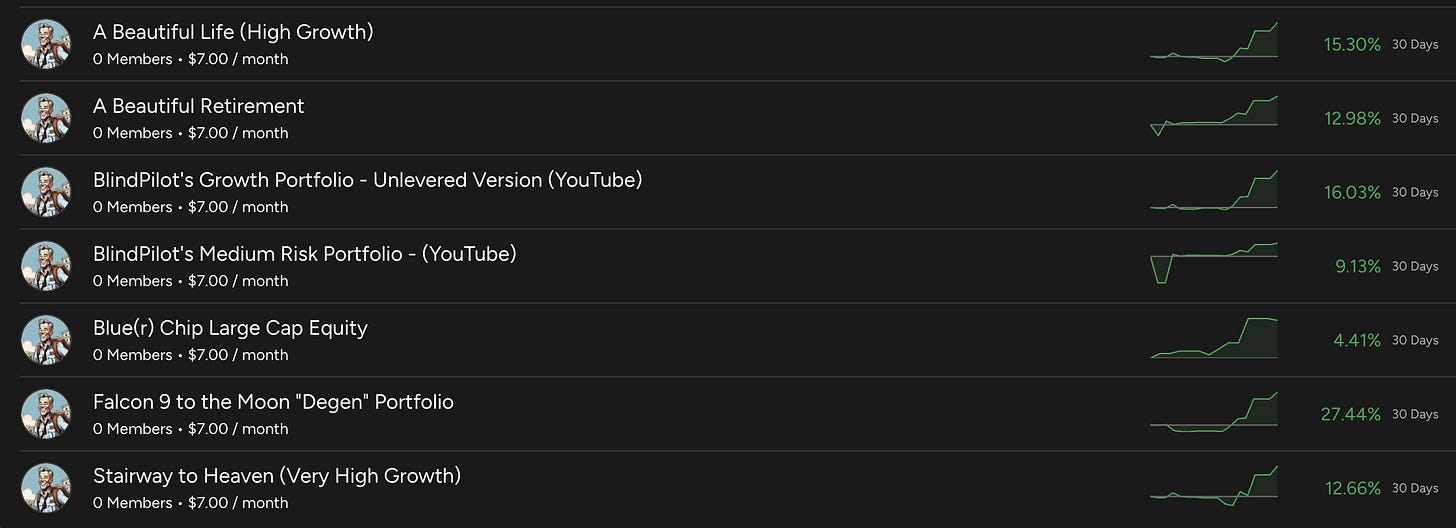

In this space, as a subscriber, you will also have access to the 7 portfolios below, trades as they occur and we will discuss and analyze the individual holdings.

However, before we dig in, here’s a fun fact. Imagine you gave your $400,000 to a truly skilled invested advisor who actually managed the money well and was lucky enough to experience a very extended bull market whereby he or she was able to earn you 10% a year, every year.

Unrealistic?

Probably, but let’s just imagine.

Here’s the problem with that - First of all lets assume this skilled manager charges 1.5% (combined explicit fees and fees in underlying assets). That’s a very likely charge or perhaps even higher. Now assume real inflation is running at 3% throughout that entire period - likely more but let us assume the Fed is roughly achieving their 2% (as reported) target.

So 10% - 1.5% - 3% gets you a 5.5% “Real Return” each year. The goal here is to increase your wealth not just maintain your wealth which is why we care about the real return. At least, that’s certainly my objective. So how many years would you have to wait around to grow from $400k to $1M in real terms with a super star investment manager?

Fourteen. 14 years to gain some real wealth. Personally I’d like to be financially free a little sooner than 14 years from now. So let’s get busy.

I have been a student of markets since 1999 - one of the most extreme periods in all of stock market history. I learned my first hard lessons in that era and have building my skills ever since. I graduated from university with distinction and earned a CFA charter not long after. I have held many investment related roles over the years but found the most enjoyment growing my own money in a way that paid investment managers either cannot seem to do or are not willing to do.

That may seem like an odd statement but a lot investment advisors are hamstrung with stringent suitability requirements and any missteps can result in liability for them. It encourages them to minimize risk (and by extension returns) focusing instead on asset gathering (salesperson) to build their book of business which they collect fees upon. I’ve rarely come across a truly excellent investment manager wearing the investment advisor hat - sad to say.

Hedge funds on the other hand theoretically have the ability to do wonderful things for investors. Unfortunately a lot of hedge funds charge fees that ensure even terrific returns will only result in moderate performance for their investors (while ensuring the fund managers themselves are well compensated). The ones that really do outperform are reserved for only those investors willing/able to invest huge sums of money minimizing the fund manager’s need to manage investors and investor expectations. And so the rich get richer and the poor are relegated to mutual funds, underperforming and over charging hedge funds and investment advisors.

So my approach is to amalgamate all of the knowledge and lessons of the past into a strategy that I believe provides optimal (for me) risk and return. This is a balance that is so delicate and so difficult to get right that it sits right up there in folklore with unicorns and… well just unicorns. It’s possible though. My own personal investing results are proof of that. I began my current era of private investing in 2021. I’ll provide a brief history below.

2021

This year was a year that no long (buy and hold investor) should covet. It was year of excess and as I like to say, “castles being built in the sky”, implying little foundation underneath stock valuations. Or perhaps the greater fool theory applies best in periods like this. In the greater fool theory, you make a purchase with the hope of a “greater fool” paying more than you have in order to secure a profit. I abhor these periods - they are very difficult to navigate. Should you have a wonderful portfolio of stocks performing exceedingly well (beyond expectations) the difficulty is how to avoid selling too early but also knowing that there is little foundation beneath.

I came into this period largely uninvested (which is another story unto itself, involving a former life). I did not like the prospect of buying anything on the long side, though dabbled with some shipping longs. Predominantly however I couldn’t help but see shorts… ripe shorts everywhere. Literally every concept stock (pre-revenue, “pre-everything”…) was worth $10 billion or more. It was absurd. As such I took the only approach I knew shorting stocks which I felt were frauds or where I suspected management was guiding investors to unrealistic expectations. In particular and with high conviction I was short a company called GSX Techedu. This was a company so blatantly misleading wallstreet that I felt there was a high chance they would become insolvent once exposed. Indeed, this more or less transpired and the stock was delisted entirely after 3-6 months of my involvement. I shorted a number of SPACs and various other things growing my portfolio in leaps and bounds. It was a strategy that was certainly not for the faint of heart and not what I’m about to do (hopefully ever) again. It did work out miraculously well however. A wiser person would have probably sat on the sidelines and let the collapse take place and an in doing so ensured that they were there to pick up the pieces once the dust settled.

I almost felt obliged to participate on the short side bringing a sense of reality back to markets. It sounds odd but I dislike that level of euphoria. It’s damaging to everyone involved unless you’re the one cashing out (which few retail investors are). Markets are much healthier taking a gradual path higher, building on solid fundamentals.

[GSX stock below: of note the best performing stock on the NYSE in 2020 if I recall despite being a fraud]

2022

The portfolio that I started in 2021, peaked at roughly 10 fold its original value in 2022. A return that calls into question my legitimacy I would argue… Those are the sorts of returns you hear every guru on YouTube claiming to have made in a week. Except in this case with an extreme environment unwinding in 2021 (and the use of leverage on my part) I was able to double, and double and then pick up the pieces in 2022 once a lot of the tech stocks had been massacred. I was operating in a very aggressive manner which is unlike what I’m now doing (although arguable what I’m doing here and sharing is also an aggressive investment strategy) but far less so than 2021 and 2022. I have a tendency to zig when others zag and I’m not afraid to do so. It has certainly worked out poorly before as well however.

2023

I came into 2023 as long as I possibly could have been. I even owned a good chunk of Tesla for the first time ever having been a bear at various times in the companies history (yes, I was wrong on those occasions). Tesla proceeded to double quite quickly as 2023 got underway. I was too trigger happy and preferred other opportunities that were lagging and so sold Tesla after “just a 40%” profit. 2023 went on to be a trading year despite longing for it to be a buy and hold type environment. The portfolios made new all-time highs into July/August of 2023. The third quarter involved some give back as I continued to look for a more extended move up and did not want to take profits prematurely in July/August. With 20/20 hindsight that was a mistake but 2023 is setting up to be another blockbuster year especially as the 4th quarter winds down. At present (December 4, 2023) the publicly managed portfolios are showing as high as 32.5% gains since November 1, 2023. That’s fairly consistent with my personal portfolios which notable are not the same as what I manage publicly. I have many variations here publicly because I want to cover a lot of different objectives. These being my own definitions of “Low risk”, “Medium risk”, “High growth” etc. Broadly speaking however the results in these portfolios will track with my own portfolios. So as I often note, any opinions on the stocks held must be considered biased / talking my own book etc. and of course nothing contained herein is investment advice rather a window into how I manage my own portfolio both real and hypothetical.

History: 2019, 2020

In a very different capacity which I won’t espouse upon. In broad strokes, I was short leading up to the Covid crash as I watched the headlines in early January 2020 compound upon each other in the early innings in China. Whole cities were starting to quarantine and so I was short with the expectation that this turmoil, and the shutdowns abroad, would materially impact the US and western nations. Sure enough it did… and in spades. The problem for me was that in the immediate weeks and months prior to the collapse itself the market was rallying with great fervour testing my fortitude, ability, willingness and importantly capacity, to see through my views.

Suffice to say the crash was bitter sweet as my views played out but I’d taken substantial losses waiting for the inevitable. Then while markets started to collapse I started covering too early believing that the market would be more resilient than I had previously (Based on its ability to ignore immediately prior). Cutting a long story short, the month of March resulted in a mere 10% gain when a much greater pay day should have been in order. The decline went further than I expected and at the bottom I was fully long waiting impatiently for a bottom with Trump and the Fed shouting at the top of their lungs that they would do everything they possibly could to arrest the decline. “Don’t fight the Fed” which I certainly wasn’t at that point. As the rally then began with incredible thrust I was pleased having an enormous long position however after a number of historically large up days in the market I began to believe that the rebound was showing signs of a bear market bounce. I closed nearly all of my longs far too early and after another handful of unbelievably large up days I began shorting the broad market… Michael Burry style… It didn’t work out well.

Some might say well that’s clearly evidence that timing the market doesn’t work. Short going into the covid crash, long at the bottom and still the result was losses. That would be a valid comment. However, the covid “crash” and subsequent enormous rally were some of the most volatile periods in market history. I would have gladly navigated the 1987 stock market crash over the hand I was dealt - most notably the insane, truly insane rally out of 2020 and into 2021.

This was a hard lesson and a lesson that has permanently placed me in the (predominantly) long only camp. Yet I immediately went on to short the insanity and benefited tremendously. Despite the windfall profits personally being short the lunacy I still would rather never have a short position again if I can avoid it. But I think like Stanley Druckenmiller says he’s not sure that shorting has ever made him any money on its own but it does serve a purpose and has great strategic value at times. I reserve the right to short should the market become unruly to the upside but hopefully that time is far in the future. I look forward to very material market rally before then (fingers crossed).

Why am I doing this?

I’m getting really tired of hearing that you can’t beat the market and you should just put your money in ETFs or “buy the market”. The market these days consists of extreme weightings to a small number of mega cap equities. So by adopting that approach you are approaching a growth rate (at some point) that likely approximates the rate of economic growth. Also, you are more or less ignoring every fantastic hyper growth company working their way up the ranks. Surely we can find a [large] handful of great companies that will do better than the mega caps running into the law of large numbers.

I would like this to be a constructive community as well. I don’t want to do this on my own so I encourage and look forward to others contributing to the discussion and analysis. Though, if you prefer to be a fly on the wall that’s just fine as well!

Subscribe!

Should you want to come along for the ride and hear about the trades being made as well as the other portfolio variants that I manage with Savvytrader this is the place to do it. I’ll be sharing the trades I’m about to do in Savvytrader here first and likewise prior to executing in my “live” environment and recording for YouTube. I’ll also be sharing the Savvytrader portfolios here and discussing performance / strategy etc.