There’s been little to do or say for sometime now as small caps went through another, yes yet another, trough as they wait for the relief they so badly need. They’re patiently waiting for any signs of lower interest rates. That single factor will breath life into the whole sector. With that said, there are signs of life and some are moving up despite the headwind of “high” rates and higher costs of capital.

What I mean by this for example is if you are the sole owner of a company that loses $500,000 a year all the while making tremendous progress towards lets say $5M a year in revenue and $2M of net income from those revenues… investors just don’t care… nor are they interested in waiting around and funding your operating losses. Opportunity cost is the problem.

As an investor deciding if you want to invest directly in this company, you’d have to be willing to help fund that $500,000 deficit (out of your own pocket) each year until the projected revenue and profits materialize.

There is uncertainty around if/when that occurs. It’s not guaranteed.

Why fund it? Why not earn 5% on your money in the bank or with a T-bill and wait for profitability to arrive and invest then?

That’s the challenge that small, especially unprofitable, companies have even if their prospects are tremendously good. Investors would rather step aside and let someone else fund the losses and earn a positive income elsewhere in the meantime.

Can you blame them?

And this creates real problem for those companies so badly in need of funding. They need someone to believe in them enough to stomach losses while they wait.

Now why would you want to fund those losses? The reason to do so is that valuations have become so attractive that you’re buying a disproportionate amount of the business for a relatively small investment. The current reality has been priced into most stocks and in some cases the discounts are extreme and provide opportunities.

An anomaly that happens in periods such as this is when a company is worth less than the cash it has in the bank. Case in point - Caribou Biosciences. Founded by none other than Nobel Prize winner Jennifer Doudna who pioneered CRISPR technology and run by cofounder Ph.D. Rachel Haurwitz a biochemist and structural biologist.

The company IPO’d raising a fair bit of money and has drifted ever lower as they burn cash without a clear path to profitability. In the meantime, despite impressive management and talent developing innovative therapies the stock is down 90%+ and is worth $140M as of today… except that they have about double that in cash and short term investments.

The have $327M in short term assets and about $27M in total debt. So the enterprise value of the company is worth around -$120M… negative $120 million dollars.

The market feels its worth less than zero. That’s hard to achieve but not uncommon in periods of time like today. As above, the reason for the negative enterprise value is that they burn cash. So even if someone managed to buy them outright to access that cash they still have a “business” that burns cash every year. And to that point, the cash burn has been increasing. They are spending about $100M a year so best case with cash on hand they have 3 years of runway before bankruptcy is very much on the table.

So what if nothing changes? They produce nothing, they burn money… then what?

Well, here’s the short term opportunity. You can buy a company valued at less than $0 and you know it doesn’t have near term bankruptcy risk. Even if nothing material happens for the company if general sentiment improves then this company could easy trade back up to… $0 enterprise value… which ironically means an approx. 100% return from here. It’s almost a comical situation.

Now imagine something material happens, they announce a discovery or a major step forward in an existing program with real promise of profits down the road. The company could 5-10X pretty quickly and this is with limited bankruptcy risk and … limited downside… since it’s already worth less than 0…

Suffice to say the market is not being friendly towards small caps and especially small caps without a clear line of sight to profits.

To show this graphically, the largest companies in the S&P500 are leading the march higher for markets while the smaller cap stocks are performing very poorly. The ratio of large caps to small caps has not been this bad since 2008. That’s pretty bad…

Likewise, looking at something tech focused like ARKK (Ark Invest’s Innovation ETF) you can see that the malaise that continues. The froth came out of the market in 2021 and it has not returned… at all for smaller cap technology names.

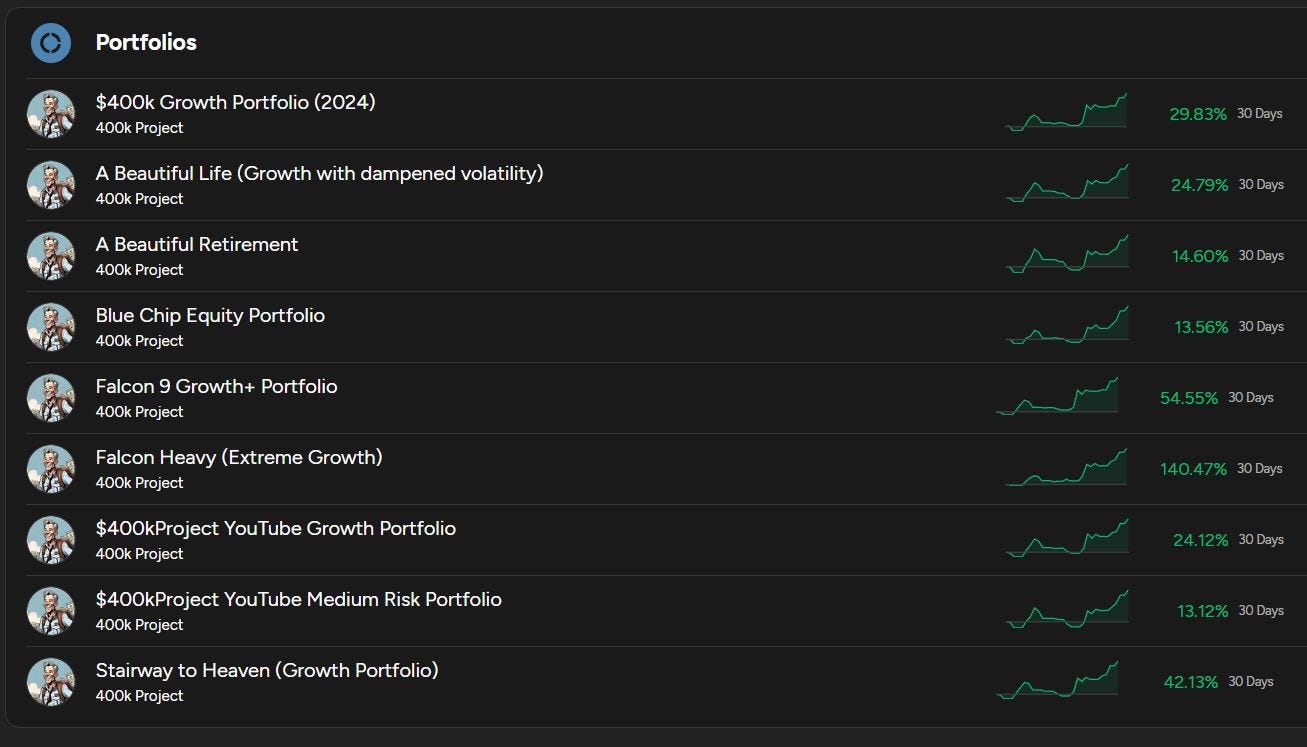

Technology is far from the only sector that looks like this - though not typically quite as dramatic. With that said, I’ve managed to buck the trend since my Savvytrader portfolios’ inceptions. The YouTube portfolios, though not recently updated, are actually probably doing a little bit better than Savvytrader if for no other reason than they already had some green under their belt prior to beginning with Savvytrader.

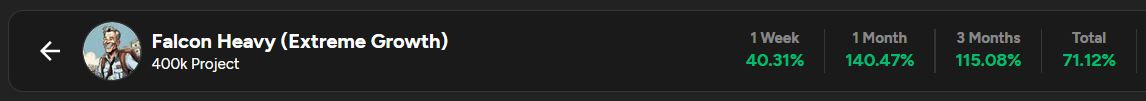

Here’s is the most dramatic of the lot - and intended to be so. This portfolio is called “Falcon Heavy” indicating it’s the riskiest-growthiest portfolio in the bunch and its not disappointing…

Investing is sometimes boring… until it’s not. Here are the full slate of portfolios at Savvytrader. I will do a comprehensive post soon to show all of the holdings and performance of each.

Here’s a link to the portfolio page if you want to see more details in the meantime.

https://savvytrader.com/400kProject